Summary

The fact that you may need to register with state agencies like Delaware Department of State is a sneaky misconception that many folks miss.

However, with the rise of remote work, states have begun cracking down and levying penalties for those who (unknowingly) fail to register.

If you're considering operating in Delaware, use this guide to:

- Explore the that triggers the need to register with the Delaware Department of State, including criteria such as physical presence, economic activity, and advertising efforts.

- Determine where and how to register with the Delaware Department of State.

- Understand additional requirements such as Registered Agents, registration with other state departments, and ongoing annual reports.

What criteria would trigger the requirement to register with the Delaware Department of State?

What's considered "doing business" in DE: Here's a breakdown of what Delaware typically considers "doing business":

- Maintaining a Physical Presence: Having a location like an office, store, warehouse, or manufacturing facility within Delaware is a strong indicator.

- Employing Staff in the State: Hiring employees who reside and work in Delaware.

- Regularly Engaging in Transactions: Frequently conducting sales, providing services, or having other business dealings within the state.

- Deriving Income from Delaware Sources: Earning significant revenue from customers or clients located in Delaware.

What's NOT considered "doing business" in DE: These are activities that Delaware does NOT consider "doing business":

- Maintaining bank accounts in Delaware.

- Holding meetings of shareholders or directors in the state.

- Using warehouses in the state for temporary storage of goods in transit.

- Defending or settling lawsuits.

- Owning or controlling a subsidiary that does business in Delaware.

Where do I register, and what else is required?

- A Certificate of Good Standing is required

In addition:

A Registered Agent is required to serve as the company's physical in-state presence to receive important legal documents. Do not fall victim to the common misconception that you can leverage an in-state employee as your Registered Agent. It's far too risky.

You'll want to review the other registrations required in Delaware. Here's a Delaware specific guide we put together.

What is the registration fee?

The fee charged by Delaware is $50 (if registration is needed).

How long does Delaware usually take to process?

Delaware usually takes approximately 2 - 3 weeks to process registrations.

What is required ongoing?

Each state has a complex schedule of required annual reports, which can vary by entity type. Let's take a look at Delaware's:

C-Corporation

- Filing Date: March 1

- Filing Frequency: Annual

LLC

- Filing Date: June 1

- Filing Frequency: Annual

Non-Profit

- Filing Date: March 1

- Filing Frequency: Annual

There is an Easier Way

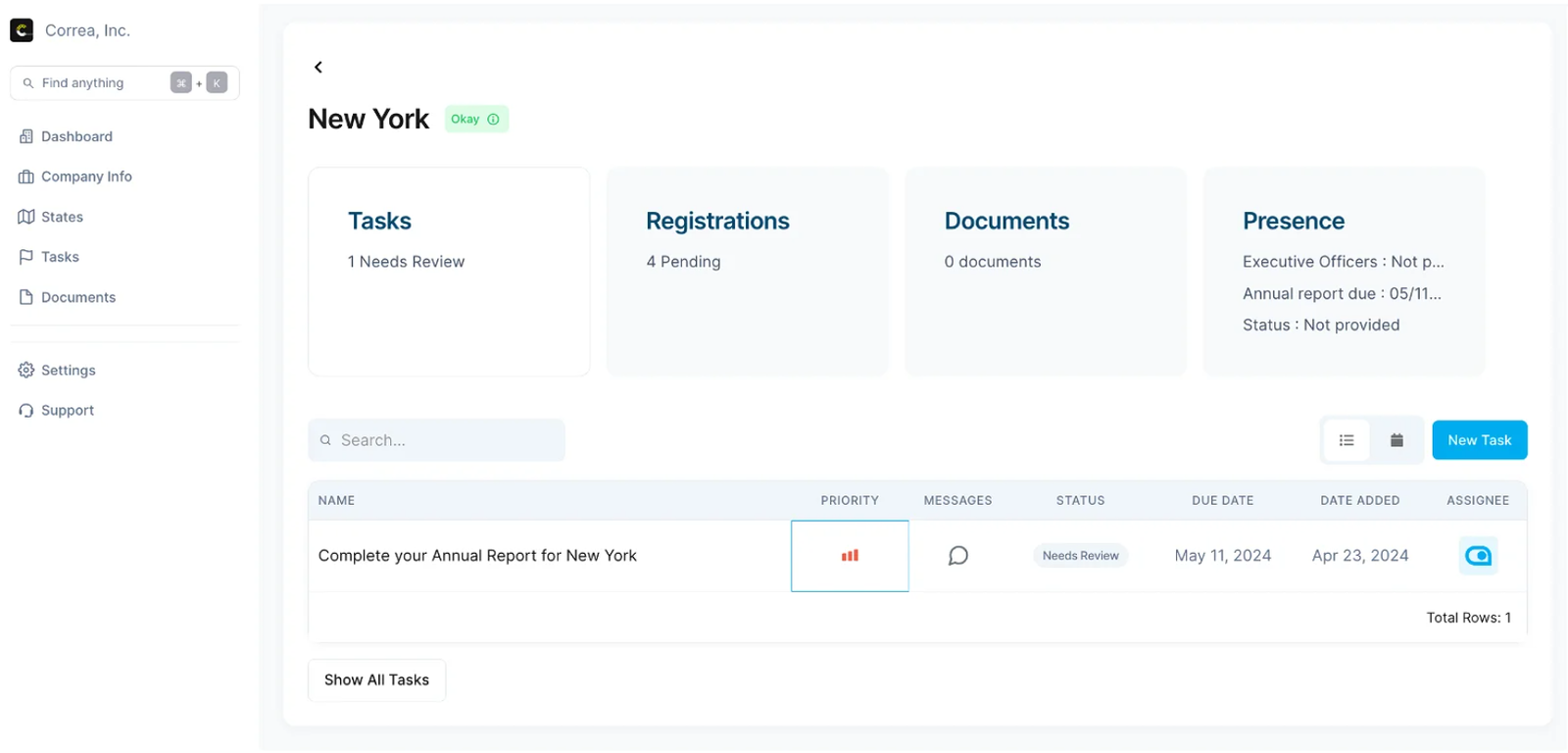

Automate registration and annual report tracking in AbstractOps.

Automate registration and annual report tracking in AbstractOps.This guide should definitely help reduce some of the confusion for Delaware. However, if you have multiple states to worry about, you may look to:

Automate state registrations and annual reports

Centralize email, snail mail, state ID’s, and registered agents, and

Take control of action items, eliminating risks before they become penalties.

Start the AbstractOps product demo to see how easy this can be.

Note: For the avoidance of doubt, nothing provided here shall contemplate, constitute or include tax or legal advice. Always double check with state agency websites for the most up-to-date requirements.