Summary

The fact that you may need to register with state agencies like New York Application for Authority is a sneaky misconception that many folks miss.

However, with the rise of remote work, states have begun cracking down and levying penalties for those who (unknowingly) fail to register.

If you're considering operating in New York, use this guide to:

- Explore the that triggers the need to register with the New York Application for Authority, including criteria such as physical presence, economic activity, and advertising efforts.

- Determine where and how to register with the New York Application for Authority.

- Understand additional requirements such as Registered Agents, registration with other state departments, and ongoing annual reports.

What criteria would trigger the requirement to register with the New York Application for Authority?

What Constitutes "Doing Business" in New York

Physical Presence: The following constitute a strong indication you're doing business in New York:

- Having an office, store, warehouse, factory, or other physical location in the state.

- Having employees or representatives working in New York.

- Owning or leasing property in New York.

Economic Activity: New York considers various activities as constituting "doing business", including:

- Selling goods or services to customers in New York, even remotely or online.

- Providing services within New York State.

- Regularly soliciting business or engaging in transactions within the state.

- Licensing or deriving income from property located in New York.

Specific Examples The following activities are likely considered doing business in New York:

- Operating a physical retail store in New York.

- Maintaining a warehouse or distribution center in New York to fulfill orders.

- Providing consulting, repair, or other professional services to clients in New York.

- Regularly selling products through an online store or marketplace to New York residents.

- Having a New York-based franchise of your business.

Important Considerations

- Nexus: New York follows the concept of nexus, which means even without a physical presence, a sufficient level of economic activity in the state can trigger tax and registration obligations. Remote sellers need to pay special attention to sales thresholds.

- Foreign Corporations: If your business is incorporated outside New York, you'll likely need to qualify to do business in the state by obtaining a "Certificate of Authority".

Where do I register, and what else is required?

New York Application for Authority

- This registration must be completed via paper form.

- A Certificate of Good Standing is required, dated within one year.

In addition:

A Registered Agent is required to serve as the company's physical in-state presence to receive important legal documents. Do not fall victim to the common misconception that you can leverage an in-state employee as your Registered Agent. It's far too risky.

You'll want to review the other registrations required in New York. Here's a New York specific guide we put together.

What is the registration fee?

The fee charged by New York is $250.

How long does New York usually take to process?

New York usually takes approximately More than 4 weeks to process registrations.

What is required ongoing?

Each state has a complex schedule of required annual reports, which can vary by entity type. Let's take a look at New York's:

C-Corporation

- Filing Date: By the first day of the registration anniversary month

- Filing Frequency: Annual

LLC

- Filing Date: By the first day of the registration anniversary month

- Filing Frequency: Annual

Non-Profit

- Filing Date: By the first day of the registration anniversary month

- Filing Frequency: Annual

There is an Easier Way

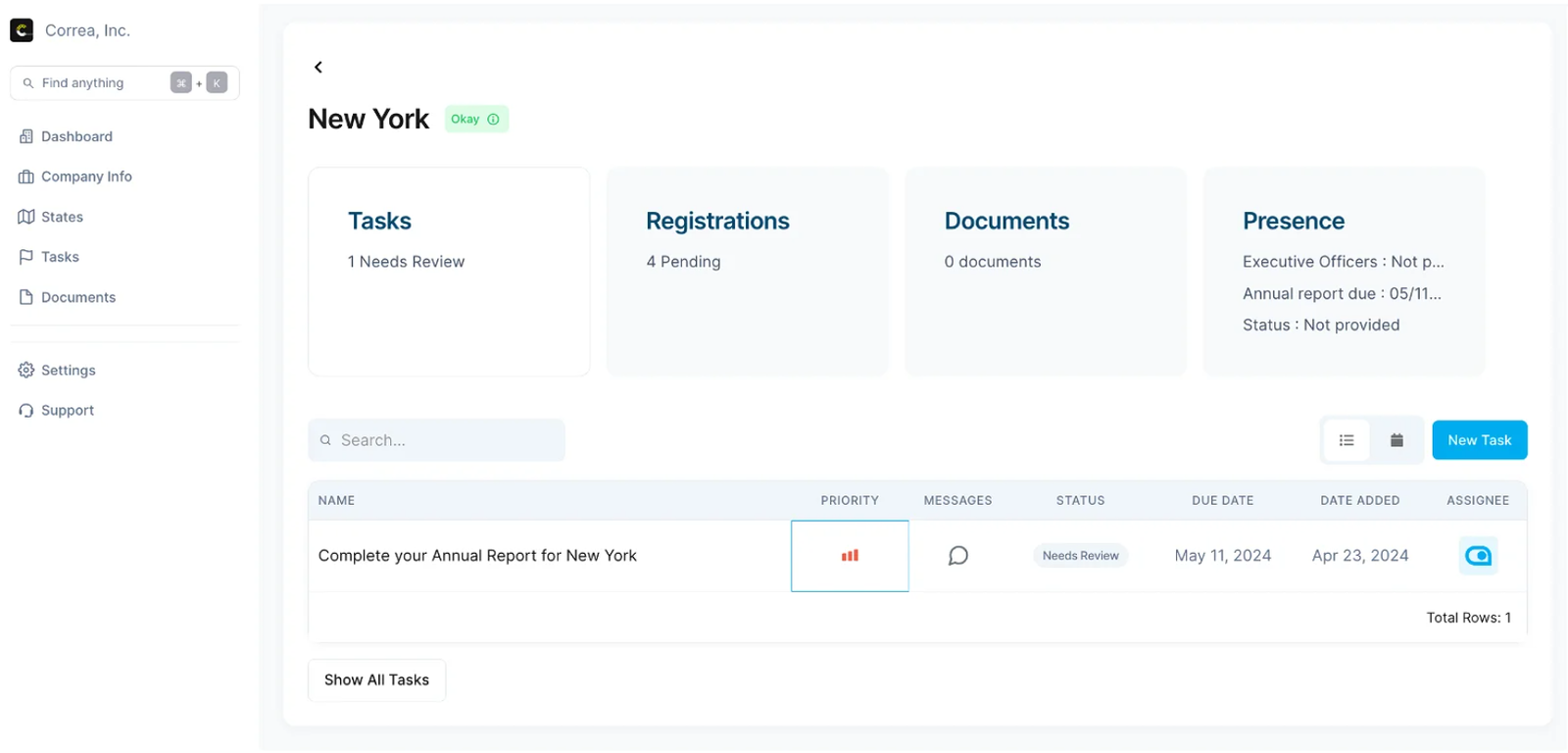

Automate registration and annual report tracking in AbstractOps.

Automate registration and annual report tracking in AbstractOps.This guide should definitely help reduce some of the confusion for New York. However, if you have multiple states to worry about, you may look to:

Automate state registrations and annual reports

Centralize email, snail mail, state ID’s, and registered agents, and

Take control of action items, eliminating risks before they become penalties.

Start the AbstractOps product demo to see how easy this can be.

Note: For the avoidance of doubt, nothing provided here shall contemplate, constitute or include tax or legal advice. Always double check with state agency websites for the most up-to-date requirements.