TLDR

Companies with remote employees demand state compliance built into their payroll platforms.

Payroll platforms debate offering it (efficiency drain) vs. not (potential revenue loss).

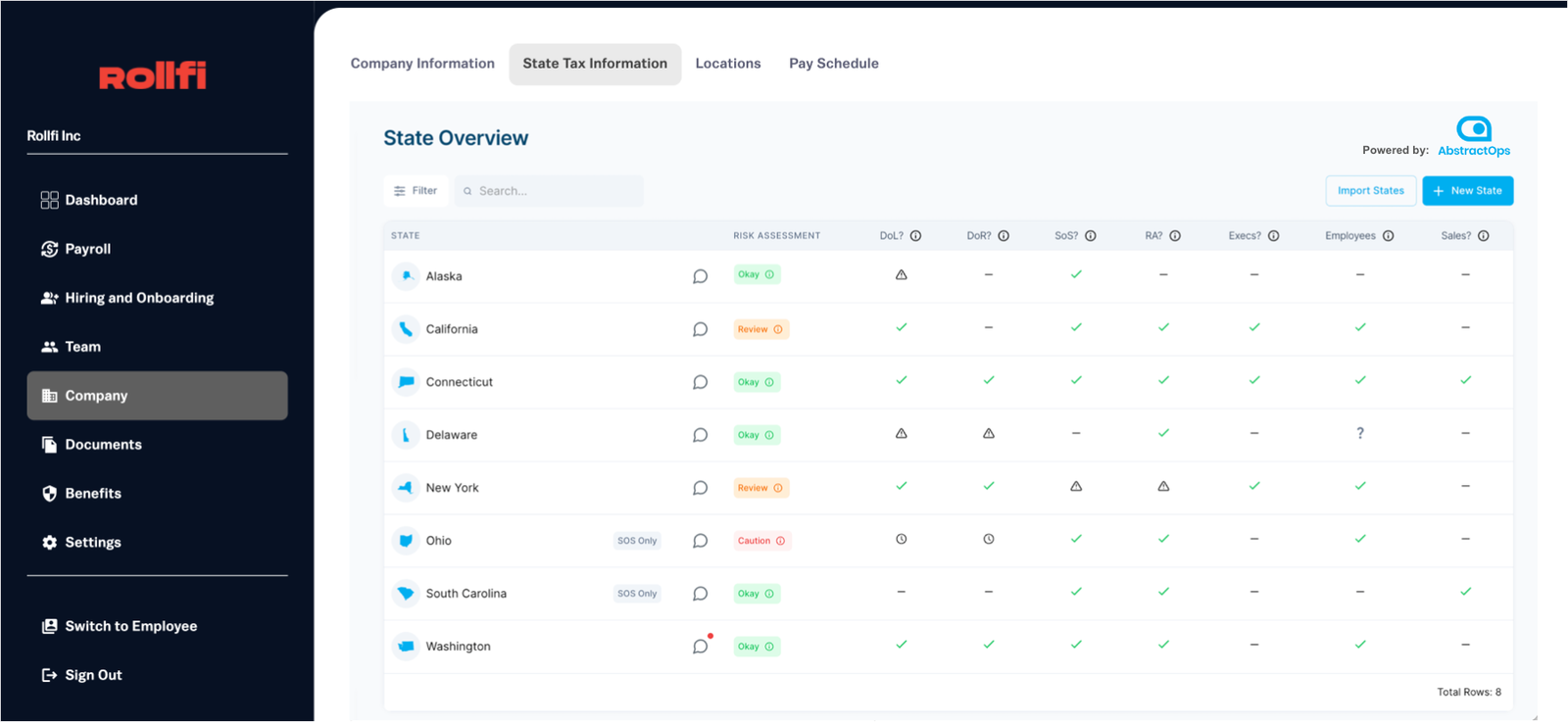

Rollfi users can offer embedded state compliance solutions powered by AbstractOps.

The problem for companies with remote employees

In each US state, if you hire a remote employee, have a physical foothold, or reach certain transaction thresholds, there is a ton of effort required to maintain ongoing state payroll tax and entity compliance.

Each state has multiple agencies with various rules and regulations, making initial registration both time consuming and extremely aggravating.

If filed late or incorrectly, companies can face thousands of dollars in fines, or blocked payroll.

Worse, registration is only the beginning.

After researching each state's requirements + determining where to register (1-4 agencies per state), companies must, procure a registered agent in more than half of them, keep track of ongoing state notices, logins, account numbers, and due dates.

They're typically doing all this manually.

As a result, when evaluating their payroll stack, leaders at these companies are prioritizing solutions that include state payroll tax and entity compliance support.

"I would rate it pretty high now knowing how much work goes into compliance," says Jessica Krane, VP of People at FloatMe. "I would almost maybe consider it a deal breaker if we were looking at a different payroll platform from our current one. It's a beast."

The problem for payroll platforms

Many payroll platforms face a no-win situation.

Offering state compliance assistance internally can quickly put a drain on operating efficiency.

Staff must learn payroll tax nuances across 50 states and over 200 agencies.

These agencies are notoriously complex, lack APIs, and often require phone calls and paper filings.

This human-intensive approach consumes valuable time and resources, and risks diverting focus away from core operations.

However, failing to offer at least some sort of assistance might be even more risky.

According to Kirubha Perumalsamy, Founder and CEO at Rollfi "It's revenue risk for the payroll platforms. A lot of first time founders don’t even realize you need to register in every state you hire a W2 in! I certainly didn’t. You can't expose end-users who don't have the time or knowledge to deal with remote employee compliance. They'll choose another solution."

How the Rollfi x AbstractOps partnership solves

In the coming weeks, payroll platforms built on top of Rollfi's technology will feature natively embedded state compliance technology powered and managed by AbstractOps.

End users of those systems will have the ability to opt in and begin using the embedded solution to eliminate the aggravation traditionally plaguing multi-state operations.

As a result, these payroll platforms will be better positioned to:

Differentiate: avoid losing potential customers who don't have registration bandwidth.

Without overhead: end-users leverage the embedded workflows, AbstractOps handles the delivery.

Payroll platforms built on Rollfi will be able to offer embedded state compliance to their customers, powered by AbstractOps.

Payroll platforms built on Rollfi will be able to offer embedded state compliance to their customers, powered by AbstractOps."It's a win-win for the payroll platforms and their customers," says AbstractOps CEO Kristin Bass. "There's so much expertise required to get compliant and stay compliant without sinking hours per week. This partnership makes the process turnkey for Rollfi's customers to deliver a critical solution to their end users."

About Rollfi

Rollfi provides the fastest way for Banks, Vertical SaaS companies, Accounting Firms, and Fintechs to integrate payroll and benefits into their offerings through our white-label solutions and robust APIs. By leveraging Rollfi’s infrastructure, businesses can unlock new revenue streams, increase customer retention, and access valuable payroll data insights. With rapid deployment and comprehensive coverage, Rollfi transforms your platform into a one-stop-shop for essential services, driving growth and enhancing customer satisfaction.

For more details, visit Rollfi.

About AbstractOps

Payroll platforms, accounting firms, and HR consultants use AbstractOps to eliminate clients’ ongoing state compliance risks, without hours of manual effort.

Over the past five years, hundreds of leaders operating in multiple states have used AbstractOps’ combination of automated technology + human guidance to replace manual activities required to get compliant and stay compliant: monitoring risks, calling state agencies, learning new requirements, hunting down account numbers, and coordinating due dates.

The company utilizes a simple pricing model, enabling partners to create a revenue-driving offering devoid of incremental service fees.

For more details, visitAbstractOps.